Why Gen Z Chooses Ultrafast Fashion and What It Means for Sustainability

The sustainability paradox in fashion

The fashion industry has made real progress in supply chains. Many companies use stronger audits, better traceability, and tighter social responsibility programs. Some have moved closer to vertical integration, which helps align design, sourcing, and production. These steps reduce waste inside the chain and make decisions faster and clearer.

At the same time, other parts of the market still run on traditional workflows. Planning cycles are longer, flexibility is lower, and factory data travels slowly. When demand shifts, this can lead to overproduction, excess inventory, and heavy discounting. For a more detailed and practical step-by-step view of how sustainable garment manufacturing can work in practice, you can explore more details here: read here.

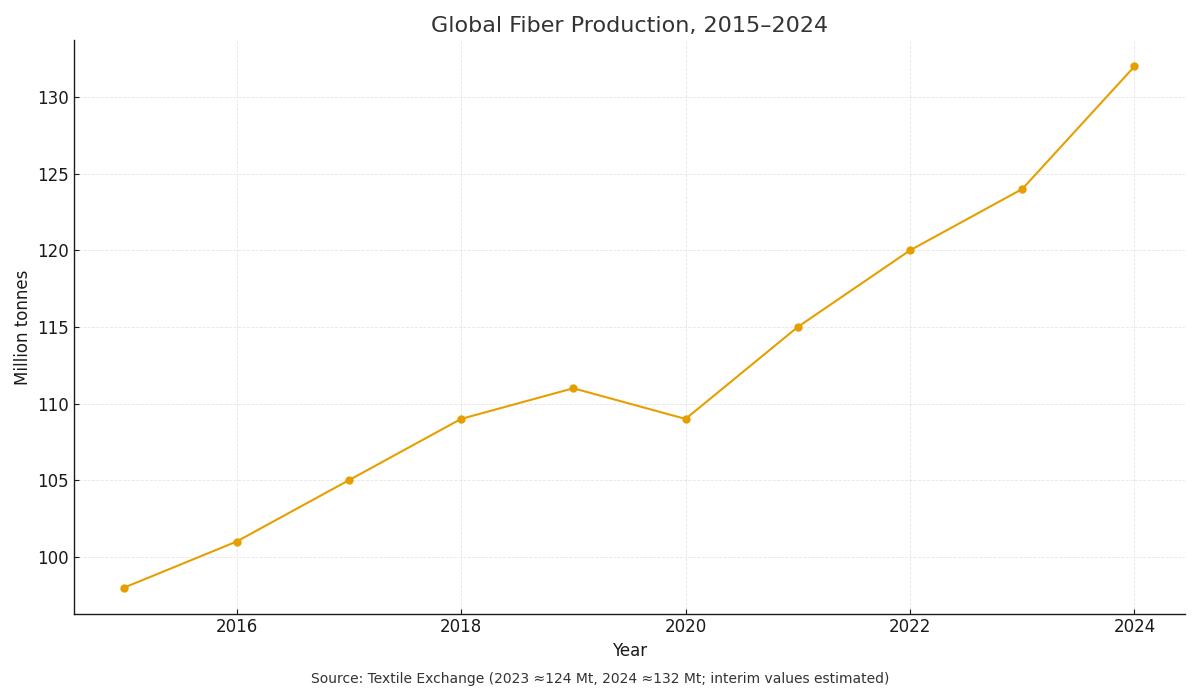

The bigger picture explains why this matters. Textile Exchange reports that global fiber production reached about 124 to 125 million tonnes in 2023 and about 132 million tonnes in 2024. That is nearly 34 million tonnes more than in 2015, and production could reach 169 million tonnes by 2030 if trends continue. Materials are improving in many places, but total volume is growing even faster. This is the core paradox the industry needs to solve.

Gen Z and the pull of variety

Many people think younger consumers choose ultrafast fashion mainly because of low prices. Price is important, but surveys show stronger reasons. In a shopper survey reported by Fashion Dive, about 80% said unique items are a top reason to buy, and 79% said the main draw is variety. Another survey by Vogue Business found that 48% of Gen Z shoppers feel algorithmic recommendations improve their shopping experience. These tools make discovery easy and keep product feeds fresh.

This behavior connects directly to product design. Many collections from traditional players look very similar. There is a lot of minimal design, safe basics, and repeat silhouettes. When products feel the same from brand to brand, young shoppers cannot find the freshness they want. If the catalog updates only a few times per season, they move to places where newness appears every day. For a short reflection on how sameness can dilute brand value and what a stronger creative lens can do, you can see my earlier note here: read this perspective.

It is also relevant that this year several established brands, including some well-known sportswear labels, reported softer sales in some markets and carried higher-than-normal inventories. Some of this reflects uneven demand and long planning cycles. Some also reflects a gap in innovation and creativity: when assortments prioritize safety over distinctiveness, sell-through drops, and stock builds up. The point is not to blame anyone; it is to show how product excitement and refresh cadence can influence results.

Behind the supply chain: myths and realities

Public discussion often assumes that ultrafast models always mean poor working conditions. Reality is more complex across the full market. Different Asian regions specialize in different capabilities. Some hubs are excellent at large, repeatable basics. Other clusters, especially in East Asia, are very strong at fashion-forward, small-batch runs with quick turnaround. This mix helps explain why platforms focused on novelty rely on those high-variety clusters.

From more than twelve years of direct work in sourcing and production in Asia, I have seen both strict compliance and real risks. Many buyers enforce strong social-responsibility rules, and many factories meet those standards. The main risk appears when factories accept orders above their real capacity. Work can then be subcontracted without proper audits. This risk is not limited to one type of company or one price tier. It can appear anywhere if visibility stops at the first factory.

Because the risk is system-wide, the solutions must also be system-wide. Brands and retailers benefit when they map the full supply chain, check capacity before peak seasons, and extend auditing beyond Tier 1. Better demand planning and shorter decision loops help factories schedule work in a more stable and responsible way. These steps improve both working conditions and product reliability.

What is next for sustainability

Real progress needs action on the demand side, not only on materials. Smarter assortment planning can reduce volume without killing creativity. Options include capsule collections, limited drops, and pre-order or made-to-order for high-risk styles. Resale, rental, and repair programs keep garments in use longer and lower waste. If Gen Z values uniqueness and variety, brands can deliver that feeling with tighter editing and better curation, not just with more units.

Policy also plays a growing role. In the European Union, separate collection of textiles starts in 2025. Extended Producer Responsibility (EPR) is rolling out, asking companies to take more responsibility for waste and recycling. A Digital Product Passport is planned to show materials, origin, and care information in a standard way. These rules will reward better transparency and make it easier to compare real progress.

Logistics is another area to watch. Industry disclosures show double-digit year-on-year increases in transport emissions for some cross-border fast-delivery models. Shifting parts of production or fulfillment closer to main markets can lower transport emissions. Still, without attention to total volume, the impact will remain high. In simple terms, supply chains are getting better, but volumes are rising. Surveys from Fashion Dive and Vogue Business show that variety and uniqueness are key reasons Gen Z buys. If brands increase creativity, update assortments more intelligently, and adopt responsible production methods, they can answer this demand without growing impact at the same speed.

← Back to homepage